Navigating the world of income tax can be daunting, filled with complex forms and regulations. While the tax return itself is the main event, a well-crafted cover letter can significantly streamline the process, ensuring your return is processed efficiently and accurately. A cover letter is more than just a formality; it’s your opportunity to provide context, highlight important details, and potentially expedite any necessary communication with the relevant tax authority. This guide will equip you with the essential tips and insights to create a tax return cover letter that stands out and serves its purpose effectively. From understanding its necessity to mastering the key components, we’ll cover everything you need to know to make this often-overlooked aspect of tax filing work for you.

What is a Tax Return Cover Letter?

A tax return cover letter is a brief, formal document that accompanies your income tax return when you file it either by mail or in some specific situations electronically. It serves as an introduction to your tax return, providing essential information and context to the tax authorities. Think of it as a cover letter for a job application – it highlights key details and helps the recipient understand the purpose of the enclosed documents. Unlike the tax return itself, the cover letter is not a legally required form, but it can be incredibly valuable for clarity, organization, and potentially, efficiency in processing your tax filing. It clarifies what you’re submitting, includes essential details to ensure your return is correctly associated with your account, and allows you to provide additional information that might not fit directly onto the tax forms.

Why Do You Need a Tax Return Cover Letter?

While not always mandatory, a tax return cover letter offers several advantages. Firstly, it provides a clear and concise overview of your submission. This is especially helpful if you’re filing a complex return with numerous schedules and attachments. The cover letter enables the tax authority to quickly understand the nature of your filing and the documents included. Secondly, it can serve as a valuable organizational tool. By listing all the enclosed forms and documents, you create a checklist for both yourself and the recipient, minimizing the risk of missing or misplaced paperwork. Finally, a well-written cover letter improves communication. It gives you the opportunity to highlight specific items, explain unusual circumstances, or provide any additional information relevant to your filing. This can significantly reduce the chances of delays or queries from the tax authority.

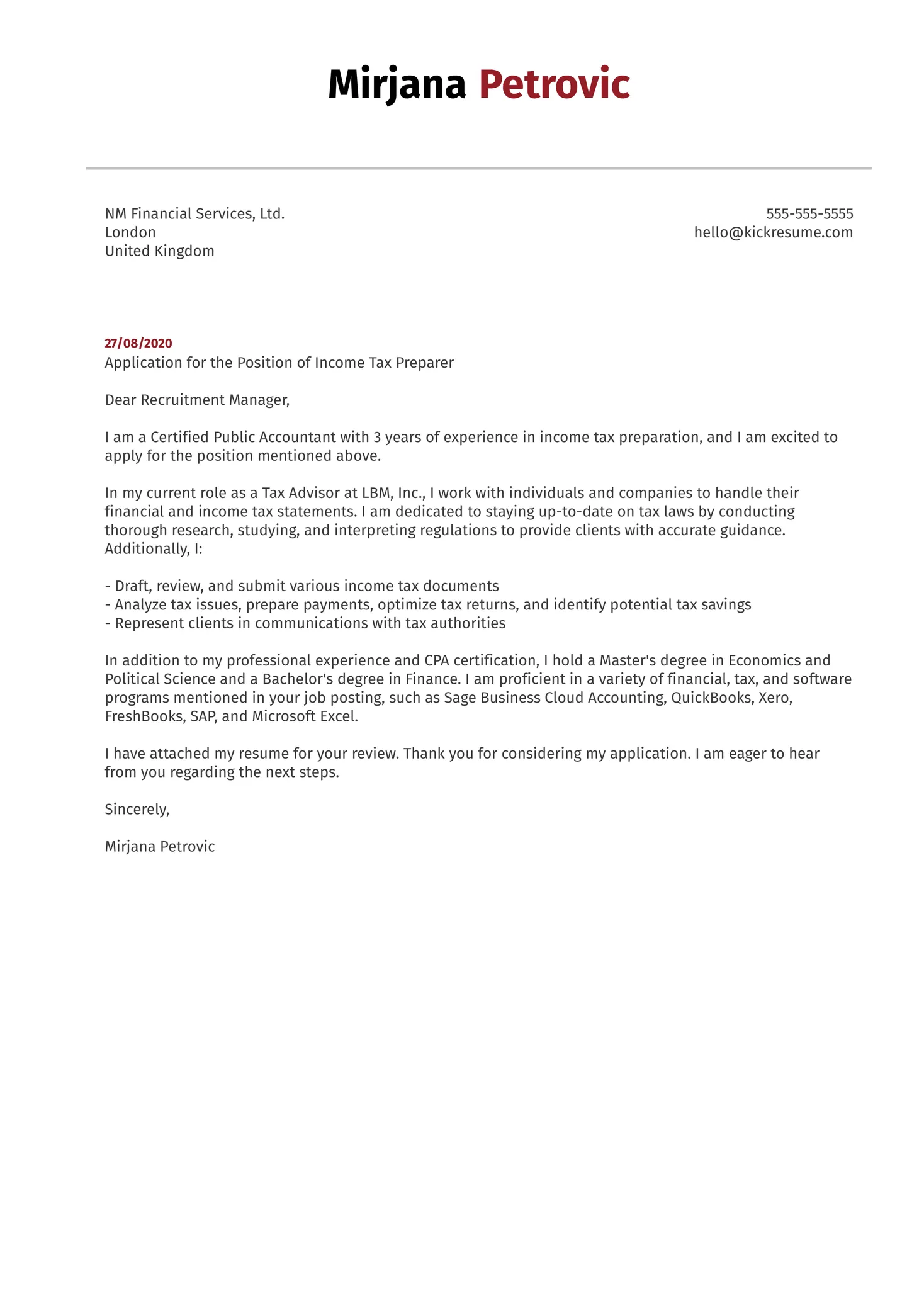

Who Needs to Write a Tax Return Cover Letter?

While anyone can use a cover letter, it’s particularly useful in certain situations. Taxpayers who are filing by mail almost always benefit from it. Taxpayers with complex tax situations, such as those with multiple income sources, itemized deductions, or business income, should strongly consider including a cover letter. It helps to clarify and organize the information. Taxpayers who are submitting amended returns, prior-year returns, or responding to tax notices find cover letters very helpful. The cover letter allows them to clearly explain the purpose of the submission and the reason for any changes or responses. Finally, anyone who wants to ensure their return is processed as smoothly and efficiently as possible can benefit from including a cover letter.

When to Write a Tax Return Cover Letter?

The best time to write a cover letter is when you’re preparing to file your tax return. Before sending your return, take the time to draft a cover letter that summarizes your filing. This is the perfect opportunity to review your return and ensure you’ve included all necessary documents. It is especially important to write a cover letter whenever you are filing a return by mail. For electronic filing, many tax software programs provide an option to include a cover letter; however, it’s less common. If you are responding to a notice from the tax authority, the best time to write your cover letter is immediately before sending your response. This allows you to clearly state the purpose of your response, reference the notice, and provide any necessary documentation. Furthermore, it is a good practice to draft a cover letter for amended returns or prior-year returns to clearly explain the changes or the reason for the late filing.

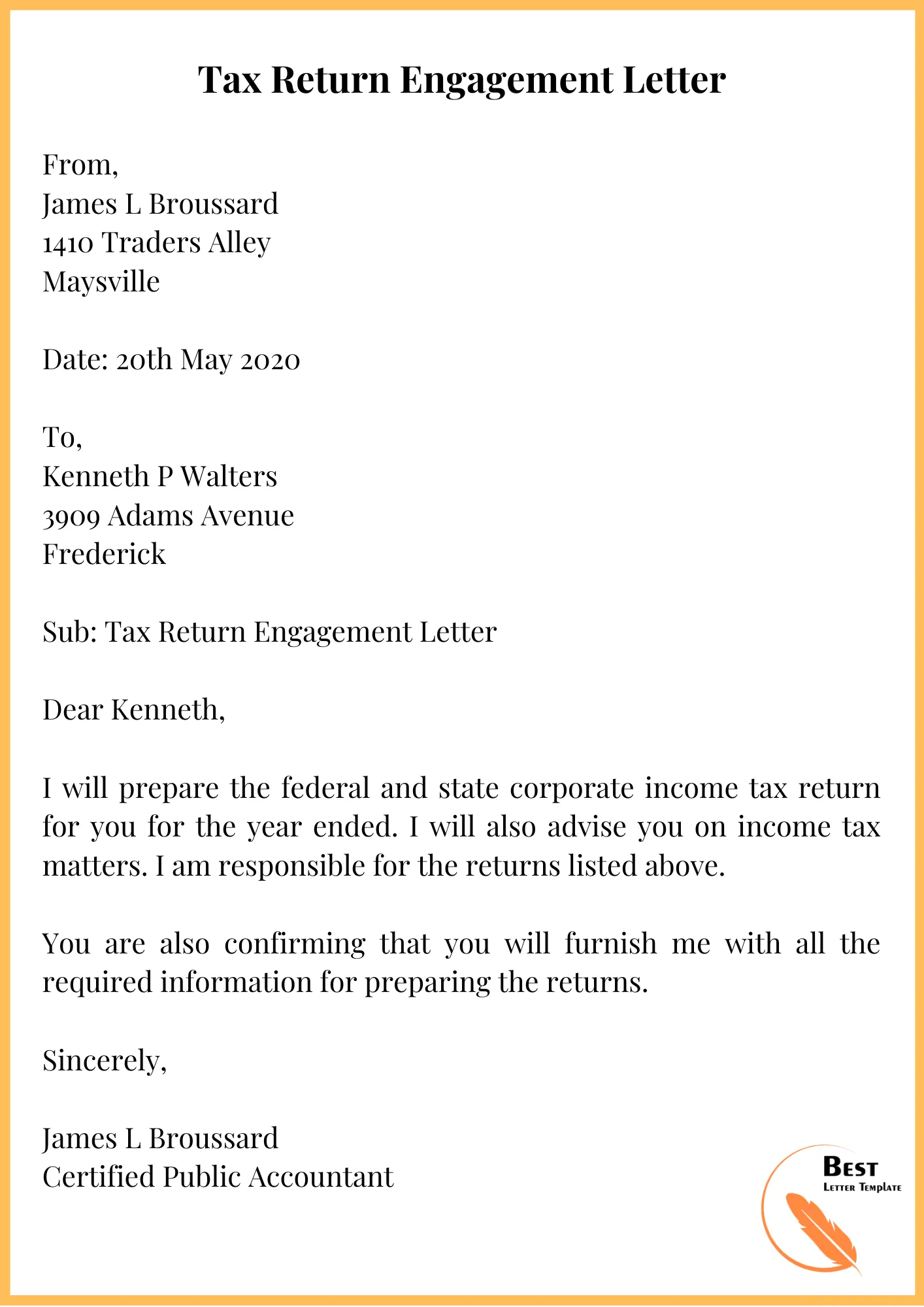

How to Write a Tax Return Cover Letter

Writing a tax return cover letter doesn’t have to be complicated. The primary goal is to provide clear, concise, and relevant information. Start by identifying the tax authority you’re addressing (e.g., IRS). Include the date, your name, address, and contact information. Then, clearly state the purpose of your letter, indicating that you’re submitting your income tax return. Include the tax year and the type of return you’re filing (e.g., Form 1040). List all enclosed forms, schedules, and supporting documents. If you are submitting an amended return or responding to a notice, clearly explain the reason. End with a polite closing and your signature. Keep it brief, professional, and easy to understand. Remember, the objective is to provide essential information quickly and accurately.

Formatting Your Cover Letter

The formatting of your cover letter contributes to its professionalism and readability. Use a standard business letter format. Start with your address and the date, followed by the tax authority’s address. Use a clear and readable font, such as Times New Roman or Arial, with a font size between 10 and 12 points. Maintain consistent margins throughout the letter. Use a clear and concise subject line, such as “Income Tax Return for Tax Year 2023.” Divide the letter into logical paragraphs, each addressing a specific aspect of your filing. Ensure your writing is free of grammatical errors and typos. Proofread carefully. The overall formatting should be neat, organized, and easy for the recipient to quickly scan and understand.

Key Components of a Tax Return Cover Letter

The essential components of a tax return cover letter ensure that the tax authority can process your return effectively. These components provide crucial information and set the tone for your communication. Each component is very important, so it’s important to organize and include them.

Taxpayer Information

Begin with your full name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN). If you’re filing a joint return, include the same information for your spouse. This information helps the tax authority correctly identify your tax record and ensures that your return is properly matched to your account.

Tax Year Information

Clearly state the tax year for which you are filing your return. For example, “Income Tax Return for Tax Year 2023.” This ensures that your return is processed for the correct year. Include the filing status (e.g., single, married filing jointly, head of household). This helps the tax authority process the return accurately based on your filing status.

Return Type Information

Specify the type of tax return you are filing (e.g., Form 1040, Form 1040-X for an amended return). Indicate whether you are filing an original return, an amended return, or responding to a tax notice. If you are filing an amended return, provide a brief explanation of the changes. If you are responding to a tax notice, include the notice number and a summary of your response.

Attachments

Create a list of all the forms, schedules, and supporting documents included with your return. This list serves as a quick reference for both you and the tax authority. Be specific about the documents you are including, such as W-2 forms, 1099 forms, Schedule A (Itemized Deductions), or any other relevant paperwork. This helps to ensure that all the necessary documents are accounted for, minimizing the risk of delays or inquiries.

Contact Information

Include your phone number and email address. This will allow the tax authority to contact you if they have any questions about your return. You can also include the best time to reach you. Providing accurate contact information can help expedite any communication and resolve any issues that may arise during processing.

Tips for Writing a Strong Cover Letter

A well-crafted cover letter makes a difference in tax filing. By following these tips, you can ensure your letter is clear, concise, and professional, resulting in smoother tax return processing. Focus on these crucial elements to write a truly helpful cover letter that gets the job done and makes the process easier overall.

Proofread Your Letter

Before sending your letter, carefully proofread it for any errors. Check for spelling mistakes, grammatical errors, and typos. Ensure that all the information you’ve provided is accurate and consistent with the information on your tax return. Correcting errors is essential to maintain professionalism and ensures your return is processed without delays caused by simple mistakes.

Keep It Concise

Keep your cover letter brief and to the point. Avoid unnecessary details or long explanations. Focus on providing only the essential information needed for processing your tax return. A concise letter is more effective and ensures that the tax authority can quickly understand the purpose of your submission without getting bogged down in unnecessary information.

Use Professional Language

Use formal and professional language throughout your letter. Avoid slang, jargon, or casual expressions. Address the tax authority respectfully. Maintain a polite and professional tone in your communication. This not only reflects well on you but also conveys the seriousness of your submission. Using appropriate language ensures your letter is taken seriously and makes a positive impression.

Avoid Errors

Ensure all information is accurate and consistent with your tax return. Double-check your name, address, Social Security number, and tax year. Verify all amounts and figures. Include all necessary attachments and documents. Errors can lead to delays or even rejection of your tax return. Careful attention to detail minimizes the risk of problems.

Where to Send Your Tax Return Cover Letter

If you are filing by mail, the address to send your tax return and cover letter will be provided in the instructions for your tax form. You can also find the appropriate mailing address on the IRS website, based on your state of residence and the form you are filing. It’s very important to send your return to the correct address to prevent delays. Make sure that the return is addressed to the correct office or department. If you are responding to a notice, the notice will contain the mailing address to send your response. Always use the address provided in the notice. For electronic filing, your tax software usually handles the submission process, so a separate cover letter is typically not required. However, some software allows you to include a cover letter or attach documents as needed.

In conclusion, a tax return cover letter is an essential tool for all taxpayers. Whether you’re filing by mail, responding to a notice, or simply wanting to organize your filing, a well-crafted cover letter enhances the entire process. Remember to focus on clarity, accuracy, and professionalism when writing your letter. By following these tips, you can write a cover letter that is easy to read, easy to process, and ultimately increases your chances of a smooth and successful tax filing experience. Embrace the cover letter as a valuable component of your tax strategy, and experience the ease of having your tax returns handled efficiently.