Why a Bookkeeping Cover Letter is Essential

In the competitive world of bookkeeping, a well-crafted cover letter can be your secret weapon. It’s not just a formality; it’s your first opportunity to make a strong impression on a potential employer. Think of your cover letter as a personalized introduction, a chance to showcase your unique value proposition beyond the information presented in your resume. It’s where you can demonstrate your enthusiasm, explain your career goals, and highlight the specific skills and experiences that make you the ideal candidate for the bookkeeping job. Unlike a resume, a cover letter allows you to tell a story, connecting your qualifications to the needs of the employer and making a compelling case for why they should invite you for an interview. Failing to include a cover letter could mean missing out on the opportunity to stand out from other applicants, especially when applying for positions that require specific skills or experience. This is your chance to provide context and personality.

Key Components of a Winning Bookkeeping Cover Letter

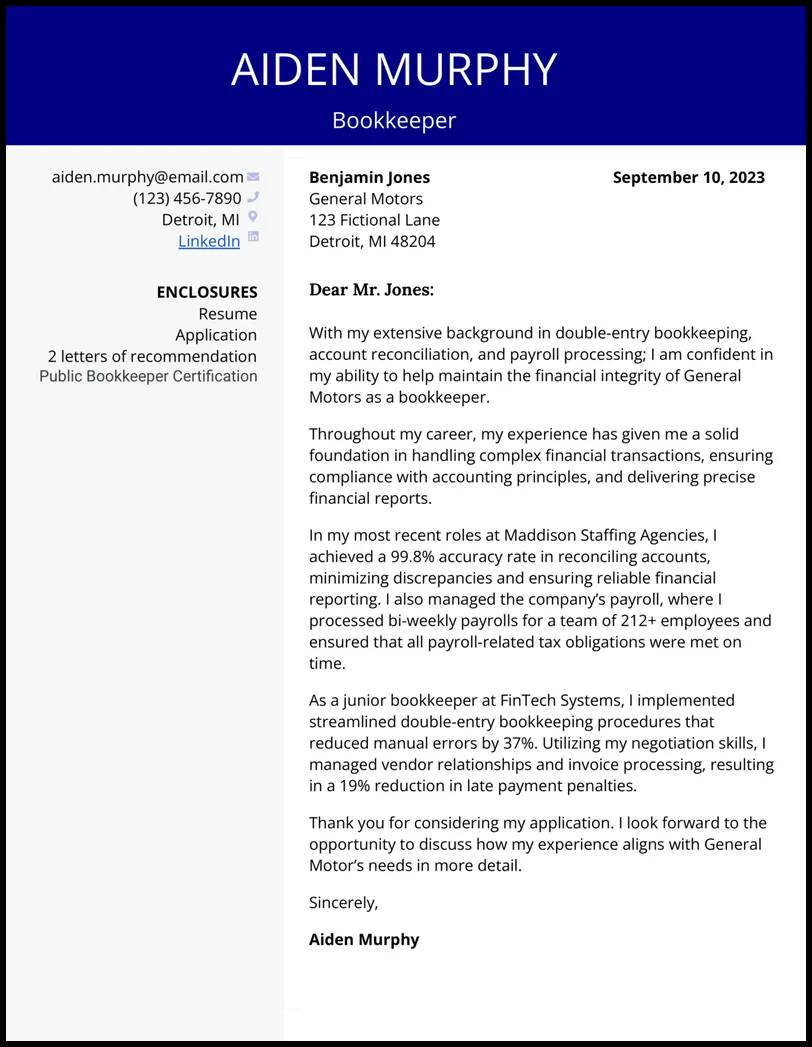

To create a winning cover letter, several key components are essential. Firstly, you need clear and accurate contact information at the top, including your name, phone number, email address, and perhaps a link to your LinkedIn profile. Then, address the letter professionally, ideally to the hiring manager by name; if you can’t find this information, a general greeting such as ‘Dear Hiring Team’ is acceptable. The body of your letter should then follow a structured format highlighting your relevant skills and experiences, quantify your achievements with numbers whenever possible to provide tangible proof of your capabilities, and convey genuine enthusiasm for the role and the company. Finally, conclude with a strong call to action, such as requesting an interview and expressing your availability to discuss your application further. This structure ensures that your letter is professional, concise, and tailored to the specific job you are applying for.

Your Contact Information and the Date

Begin your cover letter with your contact information. This should include your full name, phone number, email address, and optionally, your LinkedIn profile URL. This allows the hiring manager to easily reach you if they are interested in your application. Underneath your contact information, include the date. This is the date you are submitting your application. Ensure this is correctly formatted. This small detail provides professionalism and is a good business practice.

Addressing the Hiring Manager

Addressing the hiring manager or the specific person in charge of hiring is a critical aspect of a well-written cover letter. It immediately personalizes your application and shows that you’ve taken the time to research the company and the role. Whenever possible, find out the name of the hiring manager. This can often be found on the company’s website, LinkedIn, or the job posting itself. Use a formal greeting like ‘Dear Mr./Ms. [Last Name]’. If you are unable to find a specific name, using a general greeting such as ‘Dear Hiring Manager’ or ‘Dear [Company Name] Hiring Team’ is the next best approach. Avoid generic greetings such as ‘To Whom It May Concern’, as they lack the personal touch needed to create a strong first impression. Tailoring your greeting demonstrates your attention to detail and your genuine interest in the position.

Highlighting Your Bookkeeping Skills

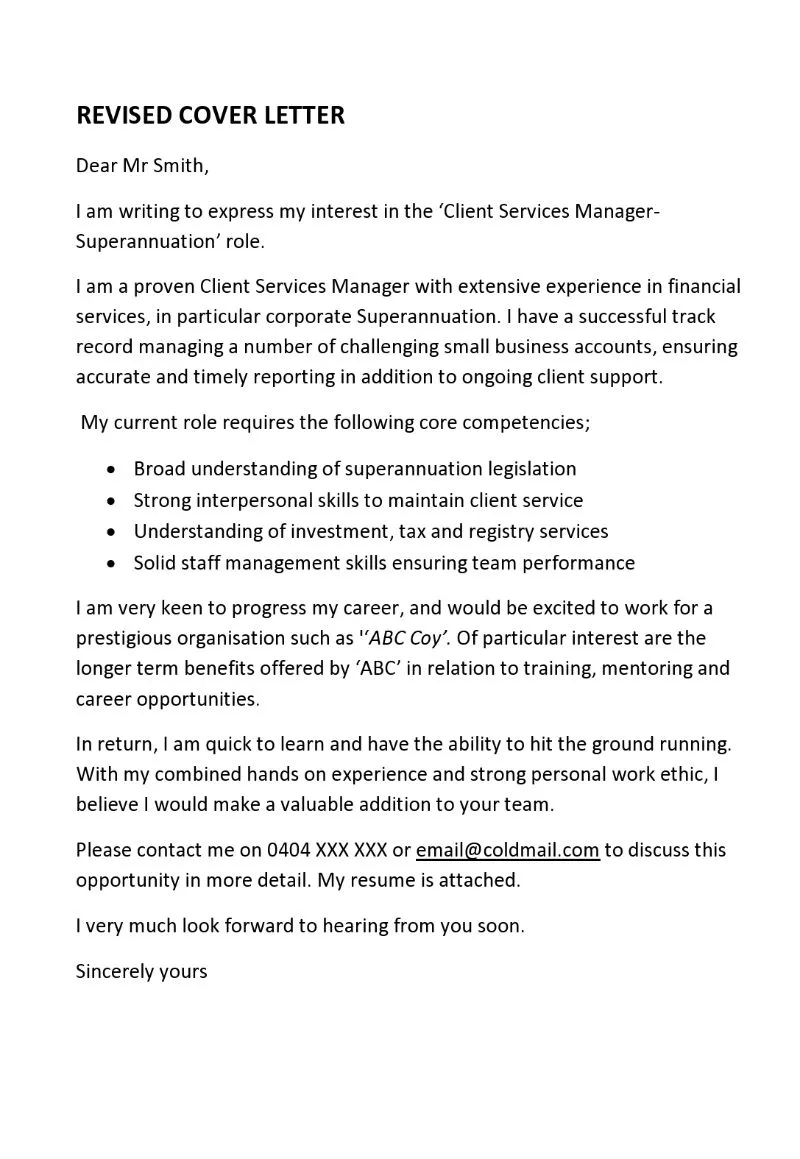

The body of your cover letter should highlight your bookkeeping skills. This is where you showcase your core competencies and experiences that align with the job requirements. Start by mentioning your relevant skills, such as accounts payable and receivable, general ledger management, bank reconciliations, and month-end close procedures. Then, provide specific examples of how you’ve utilized these skills in the past. Instead of just listing skills, describe the tasks you performed, the challenges you overcame, and the positive outcomes you achieved. For instance, ‘Managed accounts payable for a company with over 500 vendors, resulting in a 15% reduction in late payment fees.’ By providing quantifiable results and specific examples, you demonstrate the practical application of your skills and make a compelling case for your ability to succeed in the role.

Financial Reporting and Analysis Skills

In addition to basic bookkeeping skills, it’s important to highlight any experience you have in financial reporting and analysis. This can significantly set you apart from other candidates. Mention your ability to prepare financial statements, such as balance sheets, income statements, and cash flow statements. If you have experience with variance analysis, budgeting, or forecasting, be sure to mention these skills as well. Describe your role in analyzing financial data to identify trends, risks, and opportunities. For example, ‘Prepared monthly financial reports for executive management, providing insights into key performance indicators and identifying areas for cost savings.’ Demonstrating your analytical skills shows that you can not only record financial transactions but also interpret the data to provide valuable insights and support informed decision-making.

Software Proficiency

Proficiency in relevant bookkeeping software is a must-have for any bookkeeping position. List the specific software programs you are proficient in, such as QuickBooks, Xero, Sage, or any other software mentioned in the job description. Be as specific as possible, mentioning the modules or features you have experience with. For example, ‘Proficient in QuickBooks Online, including accounts payable, accounts receivable, and bank reconciliation modules.’ If you have experience with any other accounting software or ERP systems, such as SAP or Oracle, make sure to include those as well. If you have certifications or training in any of these software programs, mention them to further demonstrate your expertise. Your software proficiency is a critical skill set that employers are actively looking for, and you should highlight your abilities and training within your cover letter.

Attention to Detail and Accuracy

Attention to detail and accuracy are essential for a bookkeeper. Highlight your ability to maintain accurate records and prevent errors. Provide examples of how you’ve ensured accuracy in your past roles. For instance, ‘Implemented a double-entry bookkeeping system that resulted in a 99.9% accuracy rate in financial reporting.’ Mention any processes you use to ensure accuracy, such as regular reviews, reconciliations, and audits. Emphasize your ability to catch and correct errors, such as, ‘Identified and corrected a $10,000 error in the general ledger, preventing a significant financial misstatement.’ Attention to detail and accuracy are critical skills that set you apart from other candidates.

Quantifying Your Achievements

Whenever possible, quantify your achievements with numbers and data. This provides concrete evidence of your abilities and impact. Instead of saying ‘Improved efficiency’, say ‘Improved accounts payable processing efficiency by 20%, resulting in a reduction of processing time by 1 day’. Instead of saying ‘Managed a large volume of transactions,’ say, ‘Managed over 1,000 transactions per month with a 98% accuracy rate.’ Use numbers to show your impact, and to demonstrate the value you bring to the table. Include metrics like the number of accounts reconciled, the percentage reduction in errors, or the amount of cost savings you achieved. Quantifying your achievements not only demonstrates your accomplishments but also shows that you are results-oriented.

Demonstrating Your Enthusiasm

Your cover letter is also an opportunity to express your enthusiasm for the role and the company. Show your genuine interest by mentioning what excites you about the position or the company’s mission. Research the company and mention specific aspects that appeal to you. For example, ‘I am particularly drawn to [Company Name]’s commitment to [Company Value], and I believe my skills and experience align well with your mission.’ Explain why you are interested in bookkeeping and what you enjoy most about it. Showing your enthusiasm helps to create a positive impression and demonstrates that you are truly interested in the opportunity. Tailor your statements to the specific company and role. Your enthusiasm helps to make a favorable impression.

Formatting and Proofreading Your Cover Letter

Before submitting your cover letter, ensure it is properly formatted and proofread for any errors. Use a professional font, such as Times New Roman or Arial, and maintain consistent formatting throughout. Ensure that your paragraphs are well-structured, with clear and concise language. Check for any grammatical errors, spelling mistakes, or typos. Carefully review your letter to ensure it is free of errors, as this reflects your attention to detail. Consider having a friend or colleague proofread your letter to catch any mistakes you might have missed. A polished and error-free cover letter will leave a positive impression and demonstrate your professionalism.

Call to Action Requesting an Interview

Conclude your cover letter with a strong call to action, requesting an interview and expressing your interest in discussing your application further. Reiterate your interest in the position and express your eagerness to learn more about the opportunity. Include a statement such as, ‘I am eager to learn more about this opportunity and discuss how my skills and experience can benefit your team.’ Provide your contact information again, and state your availability for an interview. Finally, thank the hiring manager for their time and consideration. A well-written call to action will prompt the hiring manager to take the next step and helps increase the chances of getting an interview. By taking this step, you demonstrate your genuine interest in the position and increase the likelihood of your application progressing.